During its present cost per unit, the decentralized cryptocurrency Bitcoin’s market evaluation has surpassed the general worth of this International Monetary Fund’s (IMF) Special Drawing Rights marketplace (SDR $281 billion). Considering that the huge worldwide marketplace rout on March 12, bitcoin has climbed over 323 percent because the crypto asset’s $3,600 decrease in 2020.

The purchase price of bitcoin has improved a fantastic deal in 2020. Especially after the international marketplace crash that wiped out almost every commodity and inventory below sunlight. Then, the purchase price of bitcoin (BTC) had a tricky period at mid-March, as costs shuddered into a low of $3,600 on’Dark Thursday.’

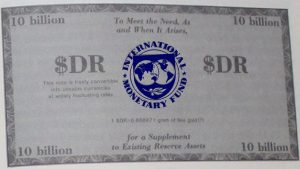

At this time, with over 18.5 million BTC in flow now, the crypto strength’s market cap is bigger compared to the Special Drawing Rights marketplace (SDR) made from the International Monetary Fund’s (IMF).

Bitcoin’s market evaluation is presently hovering over $285.5 billion and statistics from the IMF demonstrates the 204.2 billion SDR (equal to approximately US$281 billion) is allocated to both members. The SDR is thought to be a worldwide book asset and it had been designed for a supplementary global reserve asset.

Obviously, with over a quarter trillion U.S. dollars in worth, BTC’s market cap has a very long way to go to catch up with gold multi-trillion dollar market cap. In the time of publication, gold market valuation is approximately $9 trillion bucks.

The whole BTC market cap should leap over 3,500% from the present $285 billion market evaluation today. However, in October 2010, the purchase price of one bitcoin was approximately $0.12 percent , and also the value has climbed by over 12.7 million per cent since that time.

Bitcoin’s market cap had surpassed the IMF’s Special Drawing Rights marketplace in 2017. However, the cost dropped and bitcoin watched a three-year-long interval that lots of traders believed that a bear market.

Nobody is sure how much time it will remain above the IMF’s SDR this time round but lots of analysts and traders anticipate higher BTC costs from here. Meanwhile, the whole crypto market cap of 7,000+ electronic assets is nearing the half per cent markers ($426B).